Proposed PFAS Regulations: Short- and Longer-Term Implications

As the EPA rolls out national limits on the 'forever chemicals' in drinking water, Hazen delves into how new regulations could affect utilities in terms of monitoring, cost, and communications

ON MARCH 14, 2023, the U.S. Environmental Protection Agency (EPA) proposed new regulations for six PFAS compounds: PFOA, PFOS, GenX, PFBS, PFNA, and PFHxS. If these regulations are finalized, water utilities will be required to monitor for these chemicals, provide public notifications, and implement treatment if levels exceed the proposed standards. With PFAS at the forefront of water-related news – especially as these new regulations roll out – the importance of a comprehensive understanding of the proposed rules, combined with streamlined communications to customers, is becoming a pressing matter for water providers.

Proposed Limits and Related Costs

THE NEW REGULATIONS PROPOSED BY THE EPA will limit PFOA and PFOS to maximum contaminant levels (MCLs) of 4 ppt (parts per trillion) individually and regulate the combined amount of an additional four PFAS types as a mixture. However, because the EPA has indicated that PFOA and PFOS are potentially carcinogenic, a maximum contaminant level goal (MCLG) of 0 ppt has automatically been triggered.

The final rule is expected by the end of 2023 or early 2024, with a three-year implementation schedule. The agency is accepting comments on the new proposed limits until May 30, 2023.

Innovative Tools Can Assist with Compliance

THE RELEASE OF THE EPA PROPOSAL has left many utilities with a new reality: invest significant capital in treatment infrastructure upgrades or risk non-compliance. Considering rising equipment and chemical prices, regulatory uncertainty, and evolving treatment approaches, the cost and feasibility of the required treatment improvements can be hard to narrow down. To assist utilities with answering these difficult questions, Hazen has developed a variety of digital tools to help estimate the cost of upgrades to meet the new PFAS treatment objectives.

Hazen has created treatment configuration-specific cost estimating guides to address capital construction expenditures that incorporate modeling tools developed by EPA while also leveraging our extensive treatment design and cost-estimating experience. Historically, operation and maintenance (O&M) cost predictions for PFAS adsorption applications have mostly relied on vendor-provided PFAS-removal projections based on water quality and operational parameters, or expensive testing. With a wide variety of PFAS species and stringent limits, vendor provided changeout projections for granular activated carbon (GAC) were often highly variable and not adequate to provide utilities with a realistic sense of annual O&M expenditures.

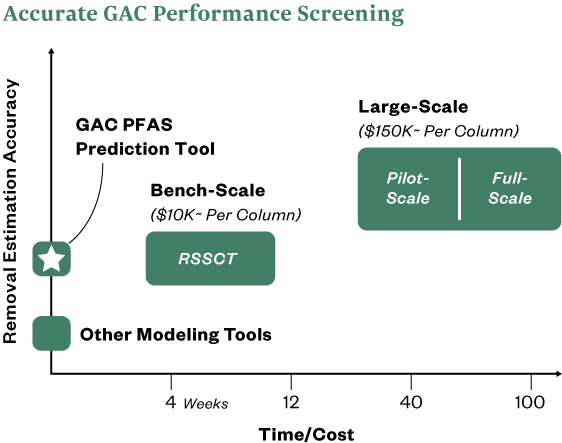

Accurate predictions of adsorbent changeout frequency are critical to developing O&M costs for utilities and providing confidence in financial planning efforts. To address the challenges of predicting changeout frequency, Hazen pioneered the development of an advanced machine learning tool that incorporates more than 600 PFAS breakthrough curves from prior work, resulting in much more reliable changeout-frequency predictions with just a few simple inputs. The power of this machine learning tool is rooted in its ability to rapidly screen through treatment scenarios with multiple GAC products, operating conditions, and water quality standards to produce reliable breakthrough predictions.

Hazen has also worked to develop preliminary treatment cost estimates for adsorption applications in Ohio, Florida, California, and North Carolina that use both machine learning outputs and capital-cost curves, resulting in Class IV cost estimates for PFAS compliance. Additional cost variables – including spent adsorbent disposal, PFAS-impacted solids handling, and site treatment goals – should also be considered as cost drivers for treatment installations.

Effective PFAS treatment requires expensive processes so municipalities need to understand available funding options to pay for upgrades. With the Bipartisan Infrastructure Law (BIL), funding dedicated to PFAS became available to utilities around the country, with much of it provided through low-interest State Revolving Fund loans and/or principal forgiveness. However, this funding often comes with strings attached and may not be available or a fitting funding source for many utilities.

The Hazen tool is used to examine different funding sources for PFAS upgrades and identify options that provide the best value and align with client funding parameters.

Understanding the Cost Implications of Financing Options: Hazen has developed an innovative dashboard that can be used to explore the intricacies of the myriad financing options a utility may use to estimate the total program costs of implementing PFAS treatment. Using readily available project and financing assumptions, a utility can better understand the short- and long-term impacts on cash flow. Using the input of typical funding sources – such as WIFIA, bonds, and grants – coupled with project duration, escalation, and total costs, a utility can visualize how combinations of funding avenues impact annual and monthly cash flow and debt service. This is powerful information that CFOs can use to develop the most cost-effective financing solutions for their utility.

Residuals in Drinking Water

COINCIDING WITH CONCERNS surrounding drinking water sources, the uncertainty of PFAS accumulation in drinking water residual streams may soon be front of mind for many utilities. In 2022, the EPA announced a hazardous substance designation for PFOA and PFOS under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), which could pave the way for the more stringent regulation of PFAS-laden drinking water residuals.

Hazen's ongoing work with AWWA and municipal clients seeks to better understand the implications of PFAS concentrations in residuals generated in conventional water treatment relative to residuals generated in PFAS separation processes.

A CERCLA designation increases the likelihood that a Resource Conservation and Recovery Act (RCRA) hazardous waste designation is possible. If classified as such, disposal alternatives for spent PFAS adsorbents – such as GAC or IX resins, including landfilling and reactivation – are expected to become more costly as the availability of applicable hazardous waste management alternatives decreases. In addition to spent adsorbent waste streams, separation of PFAS into coagulation and softening solids may also be a concern for utilities, depending on thickening and dewatering effectiveness and current residuals management practices. In a new regulatory climate, these treatment streams could become a liability for both water and wastewater utilities. Hazen’s understanding of these implications can help utilities be better prepared as regulations and the public’s understanding of the regulations evolve.

To help address these issues, Hazen is engaged in ongoing studies with the American Water Works Association in partnership with municipal clients to investigate the potential financial implications of regulating PFAS in drinking water residuals. These studies ensure that Hazen continues to offer the highest standards of service to our clients in a rapidly changing regulatory environment.

Connecting with Customers About PFAS

OVER THE LAST SEVERAL YEARS, Hazen has supported many clients in communicating crucial PFAS-related information to customers and stakeholders. Our lessons learned from these efforts include a few guiding principles that apply equally to most public health-related communications:

An effective resource for shaping PFAS communications to customers and other stakeholders is the “One Water” communications toolkit that Hazen helped develop as part of a Water Research Foundation (WRF) project.

Start early – As soon as you are aware of a potential issue, try to provide some context about the issue to your key constituencies. Information (and misinformation) spreads quickly, so utilities often need to communicate sooner than would be typically comfortable to maintain control of any situation.

Be transparent – There may be much you don’t know at this point, but being honest about that and communicating the process by which information will be gathered and shared can help avoid public panic. Provide contact information for a utility official who can respond to inquiries.

Be thorough – To maintain the confidence of customers and stakeholders, a water utility must be seen as the expert regarding water quality. Providing information on treatment processes, contaminant sources, regulations, planned upgrades, and/or operational challenges can foster trust and goodwill among key constituencies. When emerging situations arise – as with PFAS – connecting customers with authoritative third-party sources of information helps a utility assume the role of “one-stop-shop" for trusted information on the issue.

From our experience, we know that a huge effort is often not necessary to maintain control of the narrative around PFAS levels in drinking water using the guiding principles above. The Fifth Unregulated Contaminant Monitoring Rule (UCMR5) requires that every utility publicly disclose PFAS data, and this reporting will be better received by the public if it is NOT the first communication that’s distributed about PFAS in drinking water. Communicating first about process and expectations – and providing reliable resources for more information (such as the EPA) – can go a long way toward fostering customer trust and loyalty.

The toolkit includes complete tools, such as a brochure and one-pager, as well as modifiable tools, like letters and email templates to customers, text and graphics for use on utility websites, and more.

The same WRF project also produced an entirely customizable toolkit for PFAS communication related to UCMR5. Both toolkits are available to all utilities free of charge.